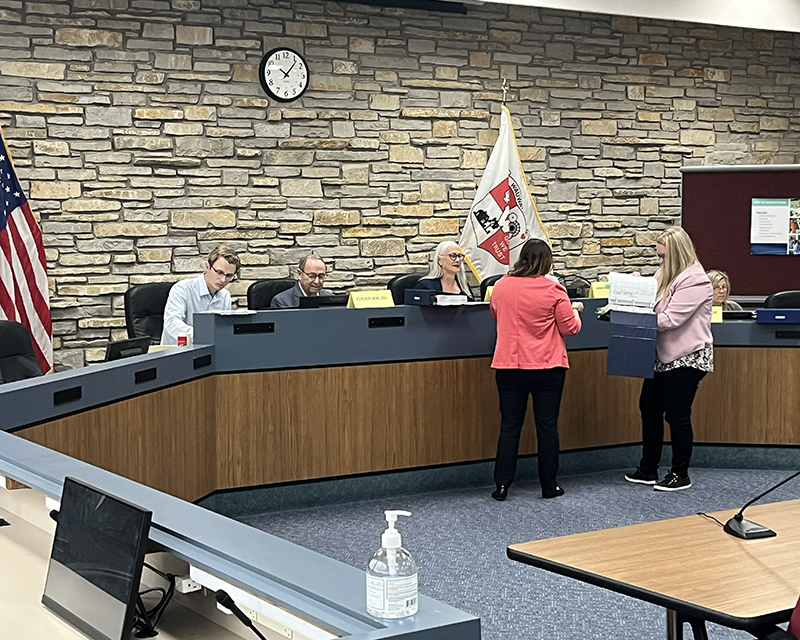

The City of Wauwatosa Board of Review launched its formal review of the city's new assessment roll on Aug. 28 after city officials reported receiving at least 624 objections, or notices of intent to object, from property owners contesting the new values assigned to their properties in the city-wide revaluation underway this year.

Objections that meet all filing requirements will be heard this fall at a series of hearings before the Board of Review, which met for two hours at City Hall in its first full meeting of the process. City Assessor Sarah Tyrrell informed the board that her office was prepared to begin responding to objections at the hearings, which are scheduled to begin Sept. 8.

Separately, for the past several weeks Tyrrell's office has engaged in a less-formal process of fielding questions and concerns from property owners during the review period known as "open book." Based on those conversations between property owners and city officials, the board granted Tyrrell's request on Aug. 28 to approve reductions to the proposed new assessments on 58 properties.

The voluntary downward adjustments, or stipulations, ranged from a reduction of about $6,000 to the assessment of a home on North 84th Avenue to several multimillion-dollar reductions at various apartment complexes in the city. This round of stipulations totaled about $50 million.

SCROLL DOWN: The full list of the 58 stipulations is reported below this story.

The largest adjustment was to the new assessed value of the Reef Apartments at 1204 N. 62nd St. in the city's southeast corner. The assessor's office initially assessed that complex at about $45 million, which would have been an increase of nearly 150% over the previous assessed value of $18.7 million. Instead, Tyrrell asked the Board of Review to adjust the new assessed value to about $29 million, still 57% higher than the previous valuation.

The Board of Review approved another significant adjustment to the assessment of Serafino Square Apartments at 9999 W. North Avenue. Before the current revaluation, the property had been valued at about $21 million but would have more than doubled to $46 million with its new assessment. After discussions with the assessor's office, the city agreed to a new assessment for Serafino Square of about $38 million, or 78% higher than last year's valuation.

Those voluntary adjustments are separate from the pending objections filed by other property owners. The city does not yet have a precise figure of how many objection hearings will be scheduled, Tyrrell told Tosa Forward News after the Board of Review meeting. Some of the 624 objection filings came in after the deadline, or they were incomplete or inaccurate, so not all of them will be heard.

The city assesses more than 15,700 properties in Wauwatosa, a large majority of them residential, which have a total value of $9.6 billion, according to the assessor's webpage.

This is the City of Wauwatosa’s first revaluation since 2019. Wisconsin municipalities are required by state law to conduct revaluations regularly to ensure assessed values do not fall too out of line with market values — within 10% above or below. In this year's revaluation, the city's new values collectively increased 54% from the previous assessment roll. Some individual property owners saw values rise even higher, while other properties lagged behind the citywide average.

REVALUATION: More info available on the City of Wauwatosa website.

Property assessments do not directly determine tax collections or tax rates, though they can affect the distribution of the tax burden among taxpayers across the whole municipality. A property owner whose value rose faster than a neighbor’s may see a tax bill proportionately higher than that neighbor.

Propety owners had until Aug. 26 to file objections, a deadline that had been extended because of the volume of submissions. The Board of Review will hold additional hearings to determine whether to consider late objections. The board held its first such hearing toward then end of the Aug. 28 meeting, when Menomonee River Parkway resident John Morris pleaded his case that his objection should be heard even though the city received it a day after the deadline.

Morris and his wife own a 3,000-square-foot home on the parkway with four bedrooms and two full bathrooms that was built in 1880. Like all city property owners, they received notice of their new assessment in July. It estimated that their home had increased in value by 75% since the last revaluation in 2019 — from $592,000 to $1,040,900. That percentage increase was significantly higher than the citywide average of a 54% increase.

"I looked at mine and said, wow, that's out of sight," Morris told the Board of Review.

The board, however, was not yet considering his objection at this meeting, only whether he had "good cause" for missing the filing deadline. Morris explained that he mailed his objection on Aug. 22, thinking that the postmark ensured it would be considered.

Board members noted that the rules specified that objections be received by the deadline, regardless of when they are mailed, though they ultimately voted in Morris' favor and allowed his objection to proceed.

"I have some sympathy for the mailbox rule," member Christopher Meuler said. "I think reasonable efforts have been made here."

The following properties received stipulated adjustments to their initial assessments at the Board of Review meeting on Aug. 28:

| Address | Initial Assessment | Adjusted Assessment |

| 3326 N Mayfair Road | $ 321,500 | $ 260,000 |

| 12140 W. Burleigh St. | $ 9,317,300 | $ 8,126,200 |

| 2929 N. Mayfair Road | $ 59,876,900 | $ 54,864,100 |

| 2355 N. 60th St. | $ 356,200 | $ 332,000 |

| 2463 N 70th St. | $ 395,900 | $ 335,000 |

| 8124 W. North Ave. | $ 514,800 | $ 343,200 |

| 2445 N. 81st St. | $ 516,200 | $ 500,000 |

| 2630 N. 86th St. | $ 520,200 | $ 480,000 |

| 2456 N. 84th St. | $ 580,200 | $ 573,800 |

| 2576 N. 91st St. | $ 914,300 | $ 771,000 |

| 2615 N 95th St. | $ 806,700 | $ 710,000 |

| 2460 N. 94th St. | $ 614,300 | $ 556,800 |

| 2454 N. 96th St. | $ 1,082,100 | $ 950,000 |

| 2438 N. 97th St. | $ 619,200 | $ 600,900 |

| 2675 N. Mayfair Road | $ 10,666,800 | $ 5,861,200 |

| 12224 W. Woodland Ave. | $ 569,000 | $ 521,000.00 |

| 9999 W. North Ave. | $ 46,065,700 | $ 37,879,200 |

| 8617 Jackson Park Blvd. | $ 663,400 | $ 599,500 |

| 2005 N. 86th St. | $ 633,200 | $ 618,500 |

| 9123 Jackson Park Blvd. | $ 941,600 | $ 825,000 |

| 8117 Richmond Court | $ 599,900 | $ 575,000 |

| 1913 Wauwatosa Ave. | $ 511,700 | $ 400,500 |

| 1942 Underwood Ave. | $ 672,800 | $ 564,800 |

| 2123 N. 68th St. | $ 245,800 | $ 138,900 |

| 2005 N. 70th St. | $ 435,200 | $ 380,000 |

| 1810 N. 73rd St. | $ 400,700 | $ 255,000 |

| 6427 W. Garfield Ave. | $ 283,100 | $ 246,500 |

| 6721 W. Lloyd St. | $ 492,700 | $ 417,000 |

| 6505 Washington Circle | $ 820,600 | $ 715,500 |

| 1907 Martha Washington Drive | $ 930,800 | $ 567,300 |

| 1566 Martha Washington Drive | $ 915,900 | $ 760,000 |

| 7022 Milwaukee Ave. | $ 485,400 | $ 380,000 |

| 1622 Church St. | $ 664,900 | $ 623,500 |

| 1520 Ridge Court | $ 706,000 | $ 674,500 |

| 1435 N. 113th St. | $ 4,354,300 | $ 3,224,000 |

| 1323 N. 120th St. | $ 387,500 | $ 345,000 |

| 1242 N 123th St. | $ 448,500 | $ 398,000 |

| 550 N. 117th St. | $ 459,900 | $ 400,000 |

| 11105 W. Potter Road | $ 334,400 | $ 315,000 |

| 10855 W. Potter Road | $ 549,600 | $ 297,700 |

| 830 N. 109th St. | $ 775,500 | $ 393,100 |

| 7821 Geralayne Circle | $ 1,454,300 | $ 1,375,000 |

| 1163 Robertson St. | $ 471,400 | $ 445,000 |

| 1167 Robertson St. | $ 564,100 | $ 455,000 |

| 737 Robertson St. | $ 443,300 | $ 323,000 |

| 7008 W. Wisconsin Ave. | $ 575,300 | $ 540,000 |

| 1205 N. 62nd St. | $ 45,775,300 | $ 29,366,300 |

| 1225 N. 62nd St. | $ 10,974,100 | $ 9,589,900 |

| 1244 N. 68th St. | $ 8,624,100 | $ 5,681,800 |

| 1248 N. 68th St. | $ 12,936,200 | $ 8,522,600 |

| 6708 Maple Terrace | $ 803,500 | $ 730,000 |

| 538 N. 62nd St. | $ 444,200 | $ 378,000 |

| 5717 W. Wells St. | $ 336,000 | $ 310,000 |

| 5805 W. Michigan St. | $ 352,100 | $ 320,000 |

| 672 N. 74th St. | $ 511,000 | $ 405,000 |

| 501 N. 104th St. | $ 420,400 | $ 399,000 |

| 300 N. 121st St. | $ 2,560,800 | $ 1,771,500 |

| 2236 Menomonee River Pkwy. | $ 605,500 | $ 469,900 |