It's that moment that comes each year in the life of a homeowner — a moment that either overwhelms with its sticker shock or brings reassurance in the feeling "that could have been worse" — when a year's worth of anticipation builds to one unalterable number.

The property tax bill.

This week, the City of Wauwatosa posted citywide data about this year's property taxes and invited property owners to visit the county's property tax portal online to get a sneak peak at what they will find on their new bills. The city has promised it will get those bills in the mail by Dec. 11, and first payments are due Jan. 31.

Whether those bills will be received with angst or relief is like a case-by-case judgment.

And it is particularly difficult this year for Tosa taxpayers to compare those bills with those that came before, for at least two reasons.

First, the city just completed a citywide revaluation, meaning that every property owner will be paying taxes based on a new assessed value. In the aggregate, a revaluation should not affect city taxes directly, because the level of taxation is determined separately through the city's tax levy. Revaluations are required by the state and intended to bring assessed values closer in line with properties' market values. The biggest impact tends to be felt comparing neighbor to neighbor. If the values in one block or neighborhood increased faster than another neighborhood, that could create disparities in how taxes are proportioned this year among all those homeowners.

The bigger disrupting factor this year, though, likely will be the Wauwatosa School District. This is the first property tax cycle that will include increased costs tied to an operational referendum and capital referendum that Tosa voters approved for the school district in November 2024. The district's operational referendum was for $64.4 million over four years, and the capital referendum was for $60 million over 20 years.

"We know this is one of those annual tasks nobody eagerly awaits, so we want to make it as easy and predictable as possible," the City of Wauwatosa said in a Dec. 8 Facebook post about the new tax bills and how to pay them.

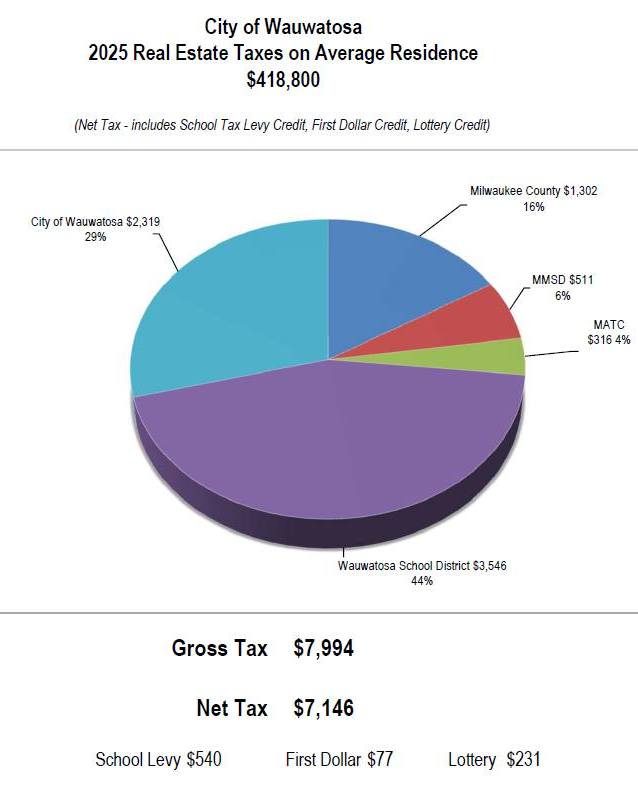

The average Wauwatosa home is now valued at $418,800, according to the city. The owner of a house with that value will now owe $7,146, with 29%, or $2,319, supporting the City of Wauwatosa tax levy. The Wauwatosa School District's portion of that same average tax bill is $3,546, or 44%. The third largest taxing authority is Milwaukee County with a 16% share, or $1,302 on an average home.

Historical data is also available on the city's website here, though the newest data did not appear to be available as of midday Dec. 9.

The city's property tax levy, which is the total revenue to be collected for city services through property taxes, was approved Nov. 18 by the Common Council at $53 million, as part of a $81 million city budget for 2026. About half of the city's expenses are services related to public safety, such as the police and fire departments.

That new property tax levy represents a 2% increase over the 2025 levy, though city officials estimated that the city portion of individual homeowners’ tax bills would increase an average of about 8% because home values have increased faster than the value of commercial properties.